In today’s fast-paced financial landscape, it’s crucial to grasp the strategies for wealth accumulation, especially if you want to power through the noise and make your money work hard for you. Fidelity Investment stands tall as one of the premier investment management firms, propelling millions of ordinary folks and institutions toward their financial goals. With a blend of astute research, technology, and a wide array of investment products, Fidelity Investments ensures that there’s a pathway for every investor to build substantial wealth rapidly.

If you’re worried that your hard-earned cash is sitting idle, fret not! Understanding how Fidelity Investments can aid in shaping your financial destiny is paramount. This article will break down the top investment strategies offered by Fidelity, equipping you with insights that’ll arm you for success in your wealth-building journey.

Understanding Fidelity Investment Strategies

Fidelity Investments isn’t just a financial company; it’s a powerhouse that has transformed the way we think about investing. As the Fidelity investment brand has grown, they’ve emphasized empowering investors with the right tools—be it through advanced technology that connects you to the market or expert insights that guide your investment decisions. Their commitment to transparency, along with their extensive research capabilities, sets them apart from competitors like Fisher Investments.

Not only is Fidelity making waves in the industry, but they’re also ensuring that you don’t have to be a Wall Street whiz to get started. For many investors, especially those aligned with conservative values, it’s refreshing to see a company that prioritizes customer satisfaction and financial education. Because at the end of the day, making informed decisions leads to financial freedom.

Top 7 Fidelity Investment Strategies to Build Wealth Fast

When aiming to supercharge your wealth-building journey, Fidelity offers several potent strategies. Here are seven top-of-the-line investment choices that can accelerate your financial growth.

1. Target-Date Funds: A Hands-Free Approach

Fidelity’s target-date funds are like cruise control for investments. They adjust your asset allocation automatically as your retirement date draws near, making investing effortless. For instance, the Fidelity Freedom Fund series gradually shifts from stock-heavy investments to more conservative bond allocations. This feature is perfect for investors who want to put their money on autopilot while still seeing significant growth.

2. Fidelity Flex Mutual Funds: Low-Cost Diversification

Say goodbye to those pesky sales loads! Fidelity Flex mutual funds allow you to dive into multiple asset classes without breaking the bank. The Fidelity 500 Index Fund, for instance, is an efficient way to gain exposure to all the big names in the S&P 500, letting you invest wisely without the high fees that typically come with traditional mutual funds.

3. The Power of Robo-Advisors: Fidelity Go

Young investors, listen up! If you’re looking for a seamless way to invest without all the fuss, Fidelity Go is your golden ticket. This user-friendly robo-advisor tailors investment portfolios based on your risk level and goals, all while removing the high fees affiliated with traditional advisory services. Just think about how easy it’ll be to build wealth while you’re busy living life!

4. Health Savings Accounts (HSAs): Dual Benefits for Growth

Have you ever thought about a Health Savings Account (HSA)? With Fidelity’s HSAs, you can stash away money for medical expenses while also positioning those same funds for retirement. After all, contributing pre-tax income is a win-win situation. By allowing the potential for growth, these accounts help you maximize wealth over time, setting you up for a secure financial future.

5. Fidelity Investment Research: Informed Decision-Making

Knowledge is power, and Fidelity’s research capabilities deliver exactly that. With detailed analyses and insights on market trends, investors can make informed choices, steering clear of bad investments. Knowledge about burgeoning sectors—like renewable energy or technology—can help you capitalize on opportunities before they’re common knowledge. This real advantage is crucial, especially in today’s fast-changing market.

6. ESG Investing: Aligning Values with Growth

Are you an investor who wants your money to align with your values? Fidelity’s suite of ESG (Environmental, Social, and Governance) funds can help you grow your wealth while still standing true to what you believe. The Fidelity U.S. Sustainability Index Fund targets corporations implementing strong ESG practices, showing that ethical investing is not just possible—it can also be profitable.

7. Tax-Efficient Fund Distribution: Maximizing Returns

Understanding taxes doesn’t have to be a headache. Fidelity focuses on tax efficiency through funds structured to minimize those annoying capital gains taxes. Leveraging strategies like tax-loss harvesting to offset gains can significantly enhance your total returns. By incorporating these tricks into your investment strategy, you can see your wealth grow even faster.

Innovating Your Wealth-Building Journey

Crafting a wealth-building strategy doesn’t stop at picking a fund; it’s a full-fledged endeavor that intertwines personal aspirations, market insights, and innovative products. Aiming for wealth through Fidelity Investments means capitalizing on their diverse offerings—from automated robo-advisors to hands-on ESG selections.

Always be proactive and keep a pulse on market trends. Adjusting your strategies when necessary can lead to greater success. Fidelity’s tech capabilities, in-depth research options, and customizable investment pathways create a stable foundation. This is your year for financial growth, so get out there and conquer 2024 with confidence!

As investors, it’s your duty to remain vigilant and adapt. Building wealth isn’t just a one-time effort; it’s a continuous journey, as dynamic as the market itself. With Fidelity Investments on your side, achieving financial freedom is not just a dream; it’s part of your strategy for success.

Now go grab your financial future with both hands—it’s time to thrive!

Fidelity Investment: Fun Trivia and Interesting Facts

The Legacy of Fidelity Investment

Did you know that Fidelity Investments, founded in 1946, is one of the largest asset managers in the world? While many people focus on the wealth-building aspects of investing, they often overlook the history behind firms like Fidelity. For example, just as the epic narratives of events like the French Revolution shaped modern governance, companies like Fidelity have significantly influenced financial strategies over the decades. Their focus has always been on delivering innovative investment solutions that empower individuals. Interestingly, Fidelity’s focus on research is similar to how one would track the academic performance of standout figures like Angel Reese, whose impressive GPA exemplifies the power of dedication and strategy in achieving goals.

Investing Insights and Cultural Tidbits

In the fast-paced world of finance, it’s fascinating how often the past and present collide. When investing, it’s all about making educated decisions, akin to planning your next move when contemplating a classic legend like Elvis Presley! Speaking of surprises, did you know the financial markets often react to unexpected events? Just like Joe Don rooney had to face the music in his own career, investors need to be ready for changes that might shake up their strategies. Keeping an eye on wildlife, like the efforts of Florida Fish And Wildlife, can also teach valuable lessons in sustainability and community focus that some investors now prioritize.

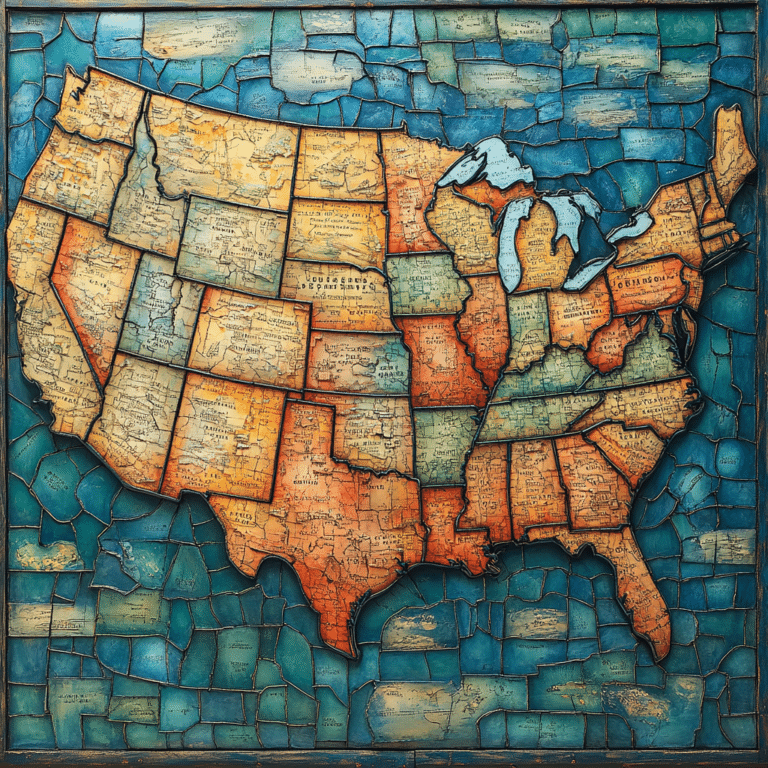

The Ever-Expanding Investment Landscape

As investment landscapes shift and flourish, staying informed can mean the difference between success and regret. Fidelity’s approach is like the varied styles seen in black art, showcasing a diversity of perspectives to inspire future collectors and investors alike. A savvy investor knows that you can’t pick a winning strategy if you don’t consider the odds and timings—just like in a game of Wordl, where every guess counts! During periods of market volatility, having a strong financial strategy akin to a well-made Canada coat can keep you warm in cold financial climates. So remember, arm yourself with knowledge, making the most of your investment journey, and remain adaptable to thrive in ever-changing markets.