Breaking Down the Impact of the $136.6B Student Loan Forgiveness News

The financial landscape for millions of Americans has been radically altered with the staggering $136.6 billion student loan forgiveness initiative. The Biden-Harris Administration’s recent announcement highlights a tremendous milestone, effectively lifting the debt burden from over 3.7 million Americans.

Key details of the loan forgiveness plan include unprecedented adjustments to income-driven repayment (IDR) forgiveness and Public Service Loan Forgiveness (PSLF). Borrowers who’ve dutifully made payments for 20 or 25 years now face a new dawn of financial emancipation. Furthermore, this broad-reaching decree ensures that your loans should automatically qualify for forgiveness, with an encouragement to check in with your loan servicer.

The demographic most impacted by this monumental forgiveness leans heavily towards the financially strained, empowering many to redirect resources to vital living expenses or even into our economy. Yet, there’s an underlying stir among the populace – one that questions the equity and overall justice of this massive financial pardon.

As for the economic implications, we’re talking about a significant cash injection back into the pockets of the common American. However, it’s not without its potential ripples, stirring the waters of fiscal conservatism with concerns that such sweeping measures might unbalance the scale of individual fiscal responsibility and state welfare.

Biden Loans Fulfillment: How the Current Administration is Handling Debt Relief

President Biden’s administration approaches the student loan crisis with a clear intent: alleviate the debt weights chaining down the American workforce. This strategy encompasses targeting specific policies like fixing long-standing issues inside IDR forgiveness programs and expanding PSLF reach.

Specific policies implemented provide relief that could be termed heroic for individuals serving the public interest or those in low-income brackets. The administration’s actions manifest a stark contrast to past administrations’ more conservative approaches, with the previous focus generally on maintaining the status quo and promoting fiscal responsibility over blanket forgiveness.

The stark shift reflects the Biden administration’s prioritization of financial relief strategies, with an urgent sense of empathy for those struggling under the heft of student loans. It’s a pivot from the deregulatory stance of yesteryears towards a more hands-on federal intervention policy.

| Student Loan Forgiveness News – Overview Table | |

|---|---|

| Key Information | Details |

| Automatic Qualification Period | 20 or 25 years in repayment |

| Relevant Programs | Income-Driven Repayment (IDR), Public Service Loan Forgiveness (PSLF) |

| Total Loan Forgiveness by Biden-Harris | $136.6 billion |

| Administration | |

| Number of Beneficiaries | Over 3.7 million Americans |

| Announcement Date | January 19, 2024 |

| Eligibility for IDR Plan | Based on income and family size |

| Monthly Payment Calculation | Proportional to borrower’s income and family size |

| Potential Legal Actions for Non-Payment | Litigation, wage garnishment, withholding of tax refund |

| Action Timing for Non-Payment | Within 5 days prior to the announcement |

Billion News: The Fiscal Details Behind the Monumental Loan Forgiveness

Take a closer look at the $136.6 billion allocation, and you’ll uncover a mix of government funding, adjusted budgets, and reprioritization of resources. The maneuver is akin to navigating a tightrope over a fiscal chasm – tensions run high over the possible imbalance this might cause in the federal ledger.

The budget distribution carries the weight of this financial behemoth across various channels, aiming for the most efficient dispersal to quench the thirst of debt-ridden Americans. Undoubtedly, congressional response has been a cacophony of opinion, with conservative voices raising alarms over the potential for an unsettling precedent in fiscal management and the penchant for a culture of dependence masquerading as relief.

Student Loan Forgiveness News: A Closer Look at Long-Term Consequences

We stand at the crossroads of precedent and prediction. With this sizable student loan forgiveness, we can forecast a ripple heading towards future higher education costs – will this lead to inflated tuition fees, assuming federal backing will always swoop in to save the day?

Borrower behavior could undergo a transformation too. With the prospect of forgiveness looming on the horizon, are we nurturing a mindset of hope over disciplined repayment? This move potentially slots a new piece into the puzzle of moral hazard, prompting borrowers to play a waiting game with debts.

Moreover, we must scrutinize the impact this large-scale forgiveness program sets as a precedent. Does it erode the bedrock of personal accountability, or is it a necessary adjustment to a system skewed against those it’s meant to aid?

The Ripple Effects of Student Loan Forgiveness on the Lending Industry

The aftershocks of this decision are palpable within the lending industry. Private lenders could find themselves grappling with a new realm where federal forgiveness programs dictate the ebb and flow of the market. This could hemorrhage the competitiveness and innovation that a balanced mix of public-private lending practices once fostered.

Financial sector responses to the student loan forgiveness vary from cautious optimism to outright skepticism. The possibility of recalibrated lending practices and interest rates looms over the horizon, suggesting a need to redefine risk in a world where loan forgiveness becomes a wildcard in the deck of financial offerings.

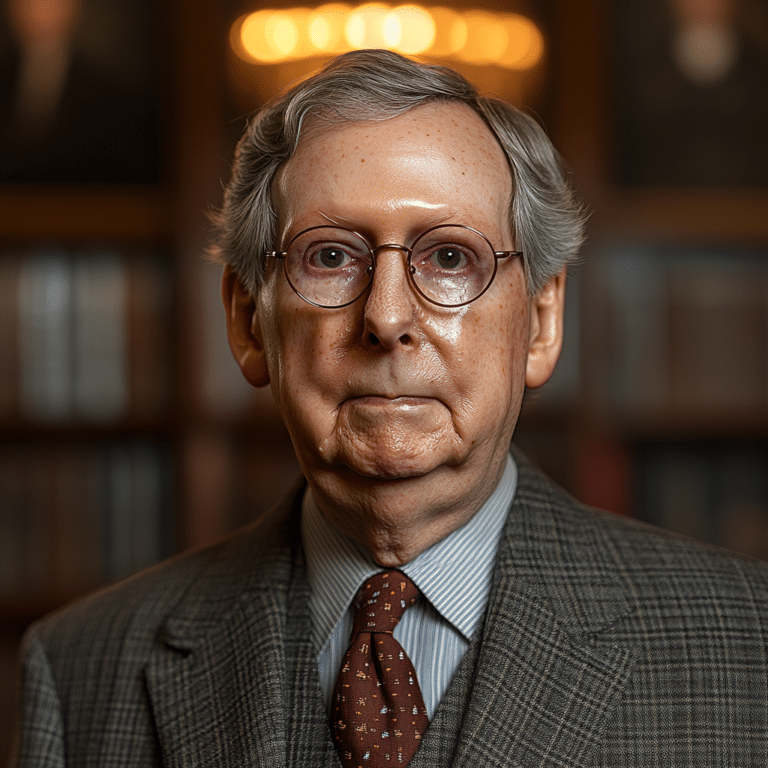

Voices from Capitol Hill: Political Reactions to the Unprecedented Forgiveness

The rumble from Capitol Hill echoes the nation’s divisions. Conservative figureheads stand firm against the imprudence of forgiving billions, while others across the aisle champion it as a victory for social equity. Commentators like Tyson Ritter emphasize the imperative for all sides to seek a middle ground that respects the taxpayers’ contributions while aiding the individuals in need.

From financial experts to higher education authorities, there’s a spectrum of sentiment, ranging from staunch opposition to emphatic support. Personal stories from constituents tug at the heartstrings, reflecting the transformative impact this decision has on individuals’ lives, yet they also reignite the ever-persistent concerns regarding the role of public opinion versus sound fiscal policy.

Moving Forward: What This Means for Current and Future College Students

The resonance of this decision will undoubtedly touch those sitting in lecture halls today and the ones yet to cross the threshold into academia.

The Conservative Today’s Take: From Dialogue to Action

As we examine the implications of this expansive student loan forgiveness, it’s clear that the trickle-down effects will influence various facets of American life, from the individual borrower level to the broader national economy. However, one thing remains certain: the dialogue around higher education financing is undergoing a seismic shift, and future policies will likely be crafted in the shadow of today’s pardon. It’s a pivotal moment that prompts a broader conversation about the value of education, the responsibility of borrowers, and the role of government in supporting the pursuit of higher learning. As updates continue to unfold, The Conservative Today remains committed to providing insights on how these developments will shape our national fiscal health, education accessibility, and the overarching conservative perspective on governing principles.

A Field Play on Student Loan Forgiveness News

Did you hear the latest on student loan forgiveness news? In a surprising twist that could rival a last-minute touchdown in a Buffalo Bills score, the government has reportedly granted a whopping $136.6 billion in student loan forgiveness. That’s like the entire student debt population scoring a financial field goal! And while folks are scrambling to see if they’re on the lucky receiving end, it’s probably not as suspenseful as the recent Unlv shooting news, which had everyone on the edge of their seats.

Speaking of edge-of-the-seat moments, let’s switch gears faster than a Crowley from “Good Omens” maneuver. Did you know that the amount of forgiven student debt could stack up almost as high as the excitement over the whimsical imaginings of Crowley Good omens mischief? It’s a heavenly intervention for those buried in debt!

Touchdown Trivia: Did You Know?

Well, butter my biscuit, have I got a nugget of knowledge for you! This massive debt relief is akin to when Zahara Jolie-pitt got accepted into Spelman College – a life-changing opportunity and a reason to celebrate for many. And while the debt burden getting lifted could feel as rare as a cameo appearance from Benjamin Brady at the Superbowl, celebrate we must, as it has countless grads tossing their caps as high as the proud parents of Benjamin Brady( would!

In the vein of shocking news that turns everything on its head, the disbelief rippling through the ranks of indebted graduates is not unlike the reaction to the rumor that Taylor Swift Was dead—total( bunk! Thankfully, that’s as false as a three-dollar bill, and the loan forgiveness isn’t a hoax. Just ask those wondering When will Scott peterson be Released, and they might tell you they’re more likely to see their loans disappear than that scenario unfold!

How will I know if my student loan will be forgiven?

How will I know if my student loan will be forgiven?

Hold your horses there! If you’ve been plugging away at those student loan payments for 20 or 25 years, you might be in for a treat. Your loans should automatically qualify for forgiveness. To avoid any slip-ups, give your loan servicer a shout to see if there’s anything else you need to do.

Is loan forgiveness happening?

Is loan forgiveness happening?

You bet! The Biden-Harris Administration has been busy bees, making fixes to income-driven repayment and Public Service Loan Forgiveness programs. As of January 19, 2024, they’ve tossed a lifeline to borrowers, forgiving a whopping $136.6 billion for over 3.7 million folks.

Who qualifies for new student loan forgiveness?

Who qualifies for new student loan forgiveness?

Well, if you’ve been chipping away at your loans for a couple of decades—20 or 25 years to be exact—you could be waving goodbye to that debt. This forgiveness is for those who’ve stuck it out with income-driven repayment plans, keeping their payments tied to their earnings and family size.

What happens if I don’t pay my student loans?

What happens if I don’t pay my student loans?

Ouch, that’s a road you don’t want to go down! If you ghost on your student loan payments, your lender or servicer might come after you or your co-signer. They can dip into your earnings or snatch your tax refund to settle the score, and nobody wants that!

How likely is it that my student loans are forgiven?

How likely is it that my student loans are forgiven?

Well, it’s not as simple as the flip of a coin, but if you’ve got your ducks in a row with the right repayment plan and meet the criteria, you’ve got a decent shot. Just remember, it’s all about hitting that 20 or 25-year mark in repayment.

Do student loans affect credit score?

Do student loans affect credit score?

Sure do, like bees to honey! Just like any other debt, your student loans are nestled into your credit report. Stay on top of your payments, and your credit score could soar. But let them slip, and it’ll sting.

Who won t get loan forgiveness?

Who won’t get loan forgiveness?

Ah, the fine print! Not all loans or borrowers will see their debts vanish. If you’ve got private loans, loans from a commercial lender, or don’t meet certain program requirements, you might be out of luck with forgiveness.

Why is my student loan balance zero?

Why is my student loan balance zero?

Don’t start the party just yet! A zero balance could be a glitch, or it could mean your loans have been transferred to a new servicer. It’s best to follow up straight away to clear up any confusion.

Should I just pay off my student loans?

Should I just pay off my student loans?

Crunching the numbers isn’t a bad idea! If you’re financially able, paying off your student loans can be liberating and save you from giving more interest than Uncle Sam needs. But if forgiveness is on the horizon, you might want to weigh your options.

What happens after 20 years of student loans?

What happens after 20 years of student loans?

After a marathon 20 years of payments, you might be crossing the debt-free finish line if you’re enrolled in an income-driven repayment plan. Reach out to your loan servicer to make sure you’re set for forgiveness.

Who owns student loan debt?

Who owns student loan debt?

The big cheese for federal student loans is Uncle Sam, but private lenders and sometimes educational institutions hold the reins on private loans.

Is student loan forgiveness taxable?

Is student loan forgiveness taxable?

Good news! Under the current rules, the IRS won’t come knocking for their cut on student loan forgiveness through 2025. But keep an eye on the tax laws—they’re as changeable as the weather.

Do student loans go away after 7 years?

Do student loans go away after 7 years?

If only they had an expiration date like milk! But no, student loans don’t vanish after 7 years. They’re like that clingy friend—they stick around until you deal with them.

What happens if you don’t pay off student loans in 25 years?

What happens if you don’t pay off student loans in 25 years?

Assuming you’re hitched to an income-driven repayment plan and you’ve been making payments like clockwork, your remaining balance might just poof—disappear after 25 years. Don’t forget the possible tax implications, though!

Do student loans go away after 10 years?

Do student loans go away after 10 years?

Abracadabra! For those putting in the time in public service, the Public Service Loan Forgiveness program could make your federal student loans disappear after 10 years of qualifying payments.

What student loans are not eligible for forgiveness?

What student loans are not eligible for forgiveness?

Not all student loans are born equal. If you’ve got private student loans, loans from commercial lenders, or you’re not on a qualifying repayment plan, you might not qualify for the governmental forgiveness magic.

Why is my student loan balance zero?

Why is my student loan balance zero?

Déjà vu! If your student loan balance is showing a big, beautiful zero, it could be an error or a sign that your loan changed hands. Time to get on the horn with your servicer and figure out what’s up.

How do I know if my student loan is federal or private?

How do I know if my student loan is federal or private?

To spot a federal student loan, it’s like spotting a bear in the woods; it’s got a federal tag on it! Check out the National Student Loan Data System or your credit report. For private loans, you’ll need to snoop through your paper trail or touch base with your lender.

How to get Nelnet student loan forgiveness?

How to get Nelnet student loan forgiveness?

All aboard the forgiveness train! If Nelnet’s your servicer and you’re dreaming of forgiveness, dive into the requirements for income-driven repayment or Public Service Loan Forgiveness programs. Then, it’s paperwork time—submit those applications to Nelnet and cross your fingers.